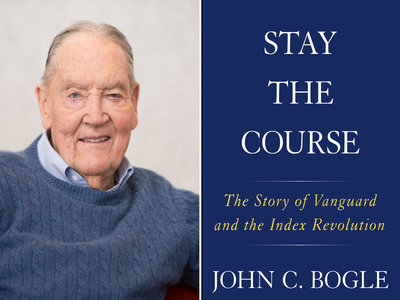

Title: Stay The Course

Subtitle: The Story of Vanguard and the Index Revolution

By John Bogle

(Wiley, New York, $34.95, 279 pages).

This, unfortunately, will be his last book, says the author, the grand old maverick of the fund industry, John Bogle. Too bad. It’s been a pleasure to see Bogle hammer the securities industry (Disclosure: It has been a profitable pleasure. Vanguard funds have helped my wife, the ever-comely Suzanne Hall, and I attain financial independence. We haven’t exclusively used them, but they have been a big part of our portfolio since I started writing about funds in the early 1990s).

However, I would speculate that most of the fund industry won’t be sorry to see him go. Still, I will be sorry.

Why?

Prejudices

I like mavericks. I like people who speak up for unusual points of view even if I am not sure I agree. I like underdogs. And It’s been a pleasure to see a pipsqueak fund company come out of nowhere in the mid 1970s and win big. The Vanguard Group of Funds adopted a unique corporate structure and investing approach as they started out in the worst of times: In the middle of the 18-month crash of 1973-1974. Vanguard eventually battled its way to the top of the fund world. It was something that even surprised Bogle.

John Bogle, the founder on what is now the biggest fund family, is approaching 90. But before he leaves the scene, Bogle says he will “not be going quietly into the night,” quoting poet Dylan Thomas. Bogle provides some fascinating details about his career and how he built the most successful mutual fund company from a few million in assets, a fraction of what the big boys like Fidelity had back in the 1970s.

“Nobody in 1974,” he writes, “really could have predicted that an upstart firm, founded at the bottom of a vicious bear market, would overcome all odds and not merely survive, but ultimately dominate the mutual fund industry. The firm’s mutual fund structure—owned by its fund shareholders and operated at an at cost basis—had never been tried before.”

Ripping off the Retail Investor

Here, in another exciting Bogle book, he complains that the securities industry often abuses its customers through outrageous fees and so-so performance. Even when he occasionally praises the industry, there always seems to be a caveat.

For example, he says some nice things about T. Rowe Price as a fund company. He says the people who invested in the company have done well. Then, just when Price executives might have been puffing up their chests, comes the inevitable ambush: Too bad the investors in T. Rowe Rice funds, Bogle complains, haven’t done nearly as well.

Stick to It

“Stay the Course” is an exciting, interesting story in how to build an investment company; of how the once little known Vanguard became the king. However, in the early years, it was dicey. It was a company that had more net redemptions than new money in its first years.

How did the modest little fund company, which today some $5 trillion in assets under management, become the top dog?

It championed a then revolutionary concept that was widely condemned as aiming for the mediocre because it wasn’t trying to outdo markets: Passive investing.

This central idea of Vanguard—index funds run at dirt cheap expense ratios with no attempt to shoot the lights out but just to get average returns—was the idea of only matching the performance of markets. This was controversial in the beginning. (By the way, Vanguard, to this day, does run some actively managed funds, notes Ben Johnson, a fund industry analyst with industry observer Morningstar. But Johnson also notes that these actively managed funds are sold at dirt cheap prices. These give average investors a chance to obtain good returns. Johnson notes that expenses are a key factor, but not the only one, in determining if someone obtains good returns).

Bogle, Vanguard and Karl Marx?

But this concept of celebrating passive investing immediately drew critics from the then big shots of the fund investing world.

Later, after Vanguard made it to the top of the greasy pole; when passive investing’s benefit had been proven, one of Vanguard’s traditional competitors accused it of promoting collectivism. Indeed, a competitor actually said Bogle was selling a kind of “Marxism.”

“One of the most respected houses on Wall Street, Sanford C. Bernstein,” Bogle notes, “published a 47-page report in 2016 with the provocative title “The Silent Road to Serfdom: Why Passive Investment Is Worse Than Marxism.”

The report, which by the way I have been unable to obtain from Bernstein despite repeated efforts, suggested that a capitalist market system in which investors invest passively in index funds is even worse than a centrally planned economy, where government directs all investment. Bernstein maintained, Bogle wrote, that it is active managers who ensure that new information is properly reflected in stock prices.

But Bernstein omits an uncomfortable fact: Most active managers don’t earn their often-considerable pay. Bogle is not, I believe, arguing that every manager should be a passive one. And he does believe that there are some outstanding active managers who do get value for clients, but here’s his warning: Most managers don’t beat indexes and that hurt individual investors. (Bogle documents that the average index fund beats an actively managed fund by 1.6 percent a year over the long term, an incredible advantage).

On a Hot Streak?

And the minority of active managers who do beat indexes are merely on a hot streak. And, by the time they are discovered, and lots more retail investors throw their money at them, they are usually no longer turning in outstanding numbers. Their popularity, perhaps, has destroyed their ability to outperform.

While one should concede that some active managers are good, there is problem of separating them from the thousands of managers who actively run money. The average investor finds it difficult finding the next great active manager as do many industry experts. In most cases, the individual investor won’t find the manager riding high in time to enjoy the fruits of a hot streak.

Overpaying for So-So Performance

So this average investor will be stuck with an average or below average manager. Most active managers don’t beat indexes. Most of them are pricey mediocrities. That is what the sage of Omaha says. Warren Buffett warns that most investors would be better investing in an index fund. Buffett is a Bogle fan.

“If a statute is ever erected to honor the person who has done the most for American investors,” Buffett wrote, “the hands down choice should be Jack Bogle.”

Those are words of wisdom in a book of investing wisdom.

![]()