The greatest con is the one in which the person who is scammed doesn’t even know it happened. He or she may know someone or something has fleeced him, but the person hasn’t a clue how it happened.

For example, in the closing scenes of the wonderful movie “The Sting”—-the Scott Joplin music alone makes the movie a wonderful watch—-a goon is hoodwinked out of hundreds of thousands of dollars. However, he has no idea who has actually carried out the sting (He mistakenly thinks the FBI is involved, actually it is a con artist who wants to get back at him for killing his friend).

Something along these lines is happening in the securities industry, according to the authors of a new book. They say that Wall Street often puts the individual investor to sleep, then picks his or her pockets. For example, they claim big mutual fund companies and brokerages confuse investors, then soak them with scandalous charges, which hurt returns.

Who Hijacked Your Assets?

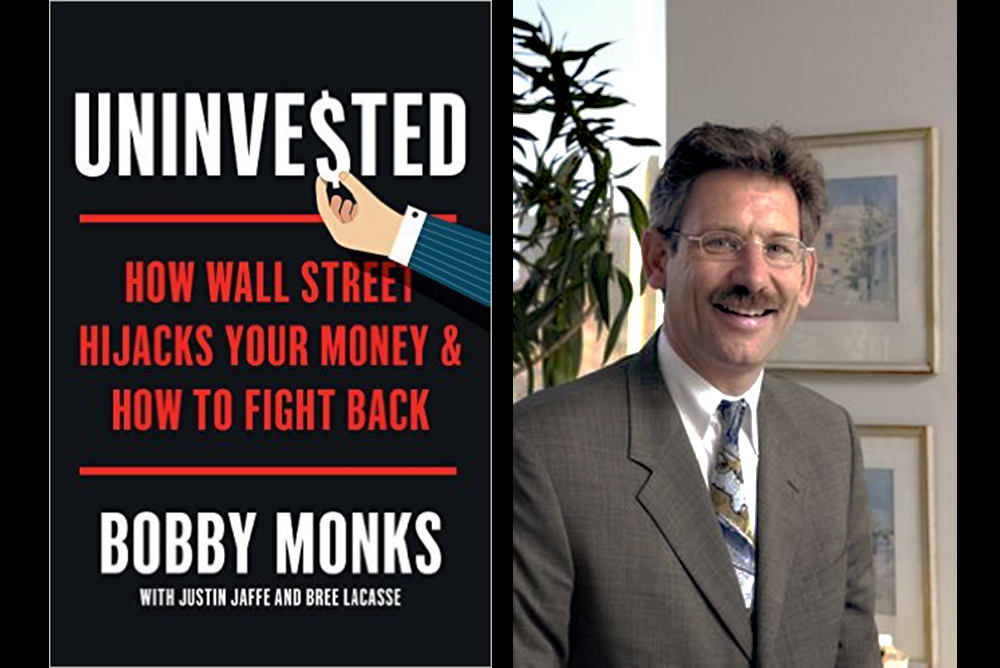

The interesting little book is called “Uninvested: How Wall Street Hijacks Your Money & How to Fight Back.” Bobby Monks, the founder of Atlantic Bank and the primary author of the book, writes that Wall Street often confuses the average investor.

“Financial firms and money managers have intentionally made investing overly complicated and then convinced us that we cannot do it on our own,” according to the book. “They have elbowed their way into every corner of investing, cultivating a financial intermediary complex that disconnects us from our capital and charges us handsomely for it.”

However, a spokesman for the Investment Company Institute (ICI), the principal trade group of the fund industry, said the industry is not overcharging.

“It is also very competitive,” the ICI spokesman added, “as evidenced by the significant and steady decline of fees paid by mutual fund investors over the last decade and a half, including average expenses of both actively managed and index funds, as well as funds offered within retirement plans.”

Sales People Everywhere

Still, the securities industry, the authors of “Uninvested” claim, is mainly populated by sales people. These people, the authors say, often have ludicrous conflicts of interest. Many times they put the interests of their employers before those of the client. They don’t live up to a fiduciary standard. The primary goal of most financial professionals is to achieve sales goals, even if it is at the expense of the individual investor, the book says.

By the way, SIFMA, the security industry’s main trade association, declined comment when I called about the book.

“Uninvested” also charges that securities industry officials often use confusing language—many of its publications are written in “Broken English”—-and they offer “suspect advice.” The industry, the book says, has “enigmatic fees,” and zero accountability. Fund managers usually have little or nothing invested in their funds.

However, the ICI spokesman said regulators, over the past few years, have simplified rules for fund prospectuses. This, the fund industry spokesman added, has led to “clearer disclosure of key information that is most relevant for individuals to make their own investment decisions. This is particularly true with regard to funds’ disclosures about fees.”

Here’s Where We Make It Up

Still, “Uninvested” is also critical of Fidelity Investments, one of the biggest fund companies on the planet, contending it charges investors too much. The book relies heavily on the analysis of former U.S. House of Representatives Financial Services Committee Chairman Barney Frank, reports from industry researcher Aite Group and fund industry gadfly John Bogle, the founder of Vanguard Funds.

In a controversial section of the book, the authors quote John Bogle as “imagining” a conversation between Fidelity Investments founder Ned Johnson and his staff. They tell him that to stay competitive Fidelity must cut fund fees in half.

Bogle imagines Johnson nixing a fee cut. “Are you guys nuts? We do all that, and we’ll ruin the firm. So what we’re going to do is nothing and enjoy the fruits of this great cash cow for as long as its lasts, until it goes away.”

One of the co-authors of “Uninvested” says Bogle’s imaginary comments are light-hearted. Nevertheless, co-author Justin Jaffee told me that Fidelity Investments continues to overcharge investors.

“What Fidelity managers are doing is legal but questionable,” he says.

A Fidelity Investments spokesman declined comment.

What’s to Be Done

Jaffee agrees that the average investor often does better by using index funds. But he adds that the best option is for investors to buy stocks. Then use their equity to “take control” of the securities industry.

This could prevent abuses, such as the over payment of CEOs, Jaffee says. He also argues that all financial professionals should maintain a fiduciary standard. That means putting the interests of the investor ahead of the firm.

Reading the book, I found myself in agreement with much of it. However, I think its charges are, at times, too broad and sloppy. For example, there’s lots wrong with the securities industry. However, there is no need “to imagine” pretend conversations with Ned Johnson and others at Fidelity.

“Imaginary” conversations, as far I’m concerned, just weaken what I believe is generally a good case against a piggy industry.

The book reinforced what I have been told by many smart financial professionals: The best deal for many individual investors is to use the lowest cost index funds. Diversify across several different lines—stocks, bonds and maybe a little cash—-and dollar cost average—buy fixed amounts each month in good times and bad— over a long period.

And, I would also recommend, then dollar cost averaging in reverse as you are drawing down your assets in retirement. These things will lower your costs—-always a smart step—and reduce your long term risk. Then you’ll have the good feeling of knowing that you weren’t the poor slob who was scammed.

![]()