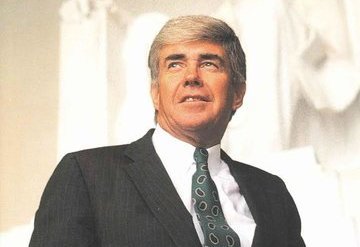

Jack Kemp, a U.S. Congressman, a Housing and Urban Development (HUD) secretary and one of the authors of the Reaganite supply side revolution of the 1980s, was the most important politician not elected president in the 20th century, the authors of this new work claim.

So begins this interesting biography–“Jack Kemp: The Bleeding Heart Conservative Who Changed America”—by longtime political reporters Fred Barnes and Morton Kondracke. They believe that Kemp was the true scion of President Ronald Reagan. Still, I think the authors, great fans of Kemp, are going overboard in measuring Kemp’s effect on American politics in post World War II America.

Personally, I believe Senator Robert Taft—the republican leader in the 1940s and 1950s who warned of the dangers of the imperial presidency, voted against NATO and, on his deathbed in 1954, warned that the United States should not send troops to bail out the French in Indo-China—was the most important leader not to be elected president.

As Americans grow more disenchanted with our imperial policies of the policeman of the world, as latter-day republicans try to disown Taft, time and again I think we come back to the dissenting, anti-war ideas of Taft. That’s even though most people don’t recognize it was Taft who originated them. America, he believed, could not save the world. It should not act as a self-appointed global policeman, in part because it calls for almost endless resources and, in part, because we lack the wisdom to bring Jeffersonian democracy to places such as Afghanistan or Iraq.

Kemp, whose greatest impact was on domestic policies and who was even interested in restoring honest money (a gold-backed dollar), had a confused set of ideas on foreign policy. He alternated over his career between hawk and dove without the kind of clear ideas he produced on taxes. For instance, he opposed the second horrible Iraqi War of 2003. But then later he wanted the United States to use sufficient force to “win it.”

Still, there’s no doubt that Kemp, a former jock who led the Buffalo Bills to two AFL championships in the 1960s, was a very important figure in the supply side revolution of the early 1980s. Kemp, along with economist allies Jude Wanniski and Art Laffer and Congressional ally Senator William Roth, were successful in passing bills that slashed income taxes under President Reagan. However, it should not be forgotten that at the same time payroll taxes were going up.

This policy of huge across the board federal income tax cuts had been tried before. Indeed, under presidents Kennedy and Harding and, to a lesser extent just after World War II under President Truman— the latter objected to the republican led cut—tax cutting became popular. Under Harding putting more money in peoples’ pockets—letting them keep more of the fruits of their labor—along with conservative fiscal policies helped pull the country out of a little known depression. It is one which I have written about elsewhere.

http://fff.org/explore-freedom/article/ways-fight-economic-depression/

These tax cuts, whether passed by the left and the right, did help rejuvenate the economy. Kemp, in advocating for his cuts, kept harping on President Kennedy’s backing of cuts in the early 1960s, much to the chagrin of many on the left. The Kemp/Roth cuts, as promised, did help expand the economy in the 1980s. Still, much to his credit, Kemp actually wanted deeper cuts and tax indexing, which he didn’t get. Still, in the case of these cuts, they also led to bigger and bigger deficits. The economic growth was supposed to happen. The deficits were not.

Why?

Unfortunately, they were later followed by tax increases. And worse than that, in the case of the Kemp-Roth cuts, supplyside advocates came to implicitly believe that, owing to tax cuts, the government could continue to go on a spending splurge. The government didn’t need to cut any programs, they believed. For instance, in the case of Reagan—often inaccurately portrayed by mainstream journalists and historians as a laissez-faire president who cut welfare programs and government departments—the government, especially on entitlements and defense spending, continued to grow. At least on spending, many of these supplysiders were closet Keynesians.

Despite promises to the contrary, no government cabinet department was eliminated under Reagan. Kemp was a big part of this “we can have it all” philosophy of cutting taxes but never cutting the welfare/warfare state. The republicans had cut taxes—and later raised some of them—but never reduced the size of government. We can see Kemp’s influence in the last republican president, George W. Bush. He cut taxes, but never vetoed one spending bill. Republicans often spent as though Keynes, not Mises or Hayek, was the greatest economist.

Years afterwards, I remember conservative George Will bragging at a conference I attended for Traders Magazine. He claimed that the republicans had proven that they could run a welfare state better than the democrats (After his speech, I ran up to him as he was exiting. I told him, “Great speech, Mr. Will,” as he started to puff up. Then I burst the balloon. “Yea, now I know why I’m libertarian.” Disappointed, George Will hurried off to his next speaking engagement).

What was the effect of the Kemp/Roth/Reagan supply side revolution?

After the big tax cuts of the 1980s, as deficits and debts soared, the government was trying to figure how it would meet its huge entitlement obligations. Nevertheless, many supplysiders parroted, again and again, “deficits don’t matter.” Yet they do.

Deficits, as economist Arthur Laffer recently conceded to me in an interview, do matter. Maybe not today or tomorrow or next year, but in the long term they do drive us down as the servicing of the debt takes up more and more of a government budget that taxpayers have to pay. Here’s where Kemp comes into the picture.

Kemp believed in cutting taxes, but not in cutting government. He was a very decent human being who was a civil rights advocate as a football player and labor leader who fought racism. (The dumbest comment in the book comes when Congresswoman Maxine Walters accuses Kemp of racism. Kemp had flaws. Racism wasn’t one of them). But Kemp, the same as many republicans, was no enemy of big government. In many ways, he was its friend.

“Kemp could be,” the admiring authors write, “careless about the size of the national debt and he opposed nearly every effort to reform entitlement or reduce benefits. For much of his career, he thought that the supply side formula—-reducing marginal tax rates and returning the dollar to the gold standard—would guarantee growth.”

He thought that there was very little if anything of government welfare programs that should be cut. He would have delighted in Will’s bragging about the republican administration of the welfare state, a welfare state his party had once opposed on principle. However, much to Kemp’s credit, he thought corporate welfare was a disgrace.

Too bad Kemp didn’t follow the logic of government subsidizing everything including corporations as bad to its logical conclusions. Cutting taxes—all kinds of taxes from corporate to individual—makes sense. But so does cutting spending.

For a society that loves liberty, lower and lower taxes along with much less government must go together with a non-interventionist, Robert Taft, foreign policy.

![]()