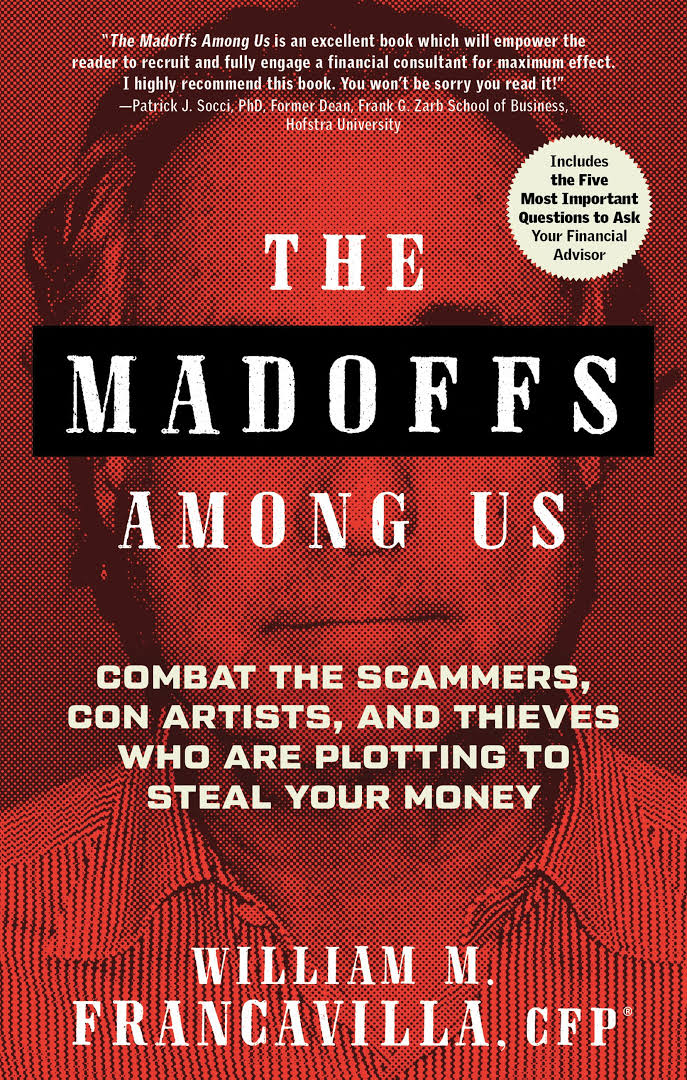

Title: “The Madoffs Among Us”

Subtitle: “Combat the Scammers, Con Artists and Thieves Who Are Plotting to Steal Your Money”

By William M. Francavilla, CFP, (Career Press, Newburyport, Mass, $15.99, 224 pages).

If you’re think you’re not affected by tube advertising, then the Madison Avenue big shots are smiling. They believe you’re hooked.

And, using that same principle, the author of this compelling book quotes con artists who say that, if you are convinced you could never be conned, then you’re already partly down the road to getting hoodwinked and you should check your wallet.

Billions Lost

How bad is the scamming problem?

The author, citing various media reports, writes that “scams exact a huge toll on consumers and society at large, with annual costs in the United States alone exceeding $100 billion.”

The author concedes that it is likely much worse—many people who are scammed are reluctant to report it.

The “Madoffs Among Us “is a very sobering and interesting book. It is written by a certified financial planner (CFP) who makes the case that skepticism through research, due diligence, dispassion and checking financial moves through third parties are essential to preventing your assets from ending up in someone’s offshore account.

And much to the author’s credit, he doesn’t argue his system or any system is completely foolproof because “I don’t believe one exists.” He writes that his advice is “merely an attempt to equip you, the consumer and investor, with tools to fortify and protect your wealth.” And you’ll need all the anti-scamming tools you can get.

It’s easy, the author contends, to con an individual, a group, even a whole nation for long periods. Just look at distant and recent history.

Among others, he cites WorldCom’s Bernie Ebbers and Enron’s Kenneth Lay (President George W. Bush’s beloved “Kenny Boy”) in his pantheon of crooks and con artists who all seemed at one time to be brilliant successes, the toast of the media, political or investment elite.

Still, they had a lot of predecessors. Indeed, there were lots of Bernard Madoffs in historical periods going back centuries. Of the latter, the author goes through some of the monetary madness of early French central banker John Law.

“Easy Money”

Law’s easy money creation schemes under Louis XV initially seemed to save the France of Louis XIV, who had ruined the country. But, as usual with all quick buck, easy money, Madoff like, schemes, they ended in disaster. One of the few disappointments of this overwise commendable book was the author’s failure to draw what I would believe is an obvious parallel between Law and the once lionized central banker of our times, Alan Greenspan. His cheap money policies, that were whooped up by mainstream media for years and in a moronic bestselling book “Maestro” by award winning journalist Bob Woodward, led to the crash of 2008. That impoverished millions of Americans. (Readers who think I exaggerate the recklessness of Greenspan are directed to page 233 of Greenspan’s memoirs. Here he writes of the disastrous results of his cheap money policy that led to a crash, “I was aware that the loosening of mortgage credit terms for subprime borrowers increased financial risk, and that subsidized home ownership initiatives distort market outcomes.”).

France under Louis XIV, the infamous sun king, and his successor Louis XV, had a predilection for spending, wars, spending, central planning, more spending and then sending the bills to the taxpayers.

Hurting a Nation

The author in focusing on the Laws, Lays, Ebbers and their macro effect on individuals, warns there is a secondary problem from their chicanery. At the same time that the Madoffs flourish, many seem to accept a culture of debt. Both scams and excessive debt are hurting us, the author says.

He warns that unabated debt “will unwind even the most robust economy. Excessive debt has traditionally caused more recessions, depressions and even wars throughout history,” this is a brilliant commonsense insight. It is followed by another: “For any American who desires financial independence, reduction and eventual elimination of debt is tantamount to financial freedom,” the author writes in a bit of wisdom that was understood by Jefferson but not by most of the career pols of both major parties who now rule us.

The author also argues that Bernie Madoff won’t be the last to perform highway robbery. It was highway robbery, he notes, that was ignored by regulators. Indeed, Madoff was actually praised for years before people came to their senses, realizing that Bernie had pinched the silverware.

Turning on Your Own

Possibly, the most difficult and courageous part of the book is when the author, a certified financial planner, is ready to eat his own. He cited the Senior Financial Exploitation Study conducted in 2012 by the CFP Planner Board of Standards. In examining the work of advisors, it found some CFP Madoffs who badly advised or might have bilked clients.

Some 74 percent of investors may have purchased unsuitable products, 58 percent may have omitted important facts, 48 percent may have misrepresented an investment and, most alarmingly says the author, 19 percent committed fraud with intent or lying. It the last number “that concerns me the most,” the author writes.

It should.

Check Your Advisor

Advisors sell themselves to clients and would be clients on the premise that they’re not stock jockeys. They’re not wirehouse, sales driven, brokers. They’re not supposed to be trying to sell you anything just because their managers are baying for them to move it. And the managers are howling because the brokerage house manufactured some dubious financial products and their big shot bosses want them to unload these products on unsuspecting investors.

Advisors aren’t supposed to do that. They are supposed to be independent and above sales quotas; they are supposed to consider the big picture for clients just as the average pol is supposed to be looking out for the average citizen. (That ends the comedy part of this review).

But can we all just be more careful, less emotional and more dispassionate? Can we heed the message of the author and avoid the Madoffs who are waiting for us in various investment and political forums?

The author, who urges the investor to carefully research whenever he or she is spending, investing or trying to help the poor, isn’t an optimist about the next generation of Madoffs. He sees them in a lot of places and wonders about the ability of the average person to resist them.

He cites Louis Harvey of Dalbar Associates who writes, “Attempts to correct irrational investors behavior through education have proved to be futile. The belief that investors will make prudent decisions after education have been totally discredited.”

No Happy Ending

That’s sobering stuff. It isn’t exactly a happy ending story in a 200-page tale of con men and political shysters who, a la Tammany Hall, would steal anything that doesn’t move.

One ends this book with the author’s commonsense warnings, which aren’t enough but can be very helpful.

*Be suspicious. If a caller wants money right away, don’t do it.

*Call closest relatives and confidents before acting on demands for money

*Stay informed. One can learn a lot from the financial disasters of others. And lots more these, the author assures us, are coming.

Study History

So history, with apologies to Henry Ford, is not “bunk.” History has a purpose. It is often a litany of mistakes, train wrecks and outrageous promises. Yet understanding how they happened through careful reading can sometimes prevent us from falling down the same hole as previous generations. And the author has skillfully used history in this book to help improve the odds that readers are not the next victims of another Madoff.

(Disclosure: In earning my dinero to survive here in taxing New York, the capital of the institutional political con class, I worked for some 15 years for Traders Magazine. My boss there once interviewed Bernie Madoff. I once spoke to one of Madoff’s sons, Mark, for a story I was doing on market making. No, I didn’t think at the time that he was trying to pick pockets and still am not sure to this day that he was. Mark Madoff, who insisted that his father hand himself over to the federal authorities once he owned up to his wholesale con, committed suicide).

![]()