What needs to be done to avoid these retirement savings problems that are making millions of Americans miserable and that the Wall Street Journal chronicled about a week ago in a front-page story?

How does one ensure that the WSJ isn’t profiling you the next time it writes about the retirement savings time bomb? Take these steps.

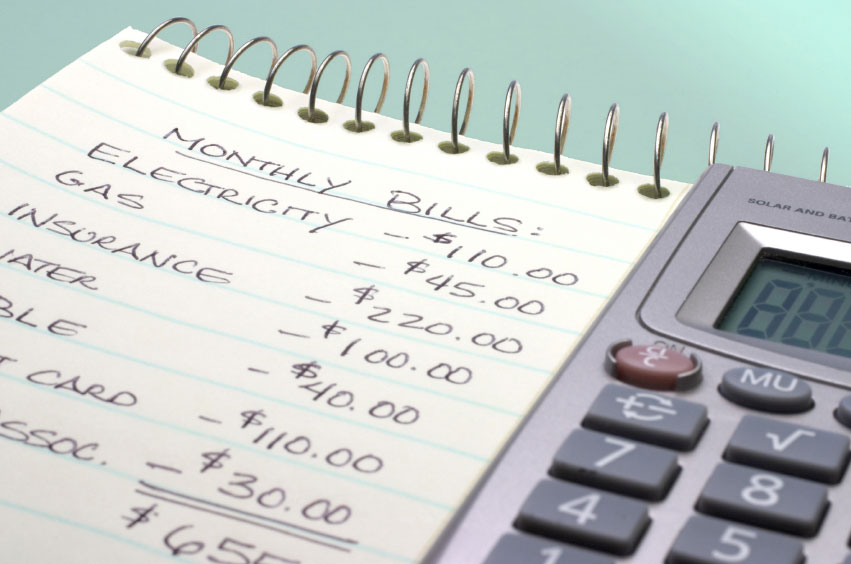

*Draw Up a Savings and Investing Plan.

It can be a simple savings/investment road map that can fit on a page. But it should be a set of simple, clear principles and it can start out something like this: I, John Jones, who has virtually nothing in savings and investments, will make a commitment to save a healthy percentage of my income each pay period. I’ll start out modestly but as my income increases I will reconsider the percentage every year or so. I will increase the percentage as I afford to do so.”

You could begin with 10 percent of your income. That would be a good start. To begin with and assuming you have decades to go to financial independence, use a simple equity fund, say an index fund with dirt cheap expenses, or possibly a balanced fund. The latter is a combination of stock and bonds. But again, be sure that the fund has very low expenses, not 1.2 percent or 1.3 percent as with many stock funds, but more along the lines of 0.2 or 0.1 percent.

My wife, the ever-comely Suzanne Hall, and I have used Vanguard funds but there are also others that can meet this requirement. Be serious about making this commitment. Save and invest each pay period. To ensure that you mean what you say, have the money put into the fund automatically each month by setting up a deduction with your checking account.

*Treat Credit Card Interest as Though It Was a Disease

Think of credit card interest as though it was a venereal disease or a cancer. In a sense, it is. Huge card debts can lead to stress. And stress can trigger all sorts of illnesses. Make the commitment, a difficult one, but make it in writing or orally and stick to it: “I will pay off my credit card debts each month and avoid all interest charges.” (See below for a suggestion in achieving this).

This isn’t an easy choice, but life is often a series of hard choices. But this sacrifice will pay off over the years. Indeed, by doing this you will be saving thousands of dollars in interest and possibly penalty charges that the credit card companies love to assess. How do you ensure that you will always have cash to pay off cards and for other challenging situations?

*Cash Is Not Trash

Even before step one, be sure you have some cash readily available, possibly in a money market account that has checking writing privileges. I would say about three months take home pay would be right. Why keep this money in an account that yields so little in interest?

It is because having this cash could keep you from having to carry credit card interest from one month to the next. And card interest is often around 20 percent. To avoid a 20 percent interest charge is a great thing. That’s because in investing no one is guaranteed 20 percent. Getting 20 percent in a year is a great, usually rare, accomplishment.

However, you are guaranteed to save a bundle, perhaps as much as 20 percent, when you don’t carry card interest from month to month.

Having some cash on hand always has another plus: In periods of unemployment, which almost every typical worker today faces over a career, you have something to fall back on for a while to avoid having to break into assets.

*Piggy Banks Everywhere

Do you want financial independence? Do you want never to be profiled in the WSJ for your retirement hardships? Have lots of piggy banks: Set up multiple savings and investing pools. Do you have a savings or retirement plan at work that automatically deducts and puts money in an account?

Unless there is some problem, you should join the plan. Some companies have generous plans. Others are so-so. But almost all offer the opportunity to accumulate significant assets over the long term and these accounts generally are portable—they can be taken to another workplace or you can manage them yourself if you leave the company.

Some are generous. My wife worked for Delta Airlines as a mechanic for a decade. Delta has a very good plan—providing a generous match—and she was able to leave the company with a fair amount of geld. I worked for a small publishing company for 15 years. For the first 10 years they provided a nice match for my 401(k) contributions. I grabbed every matching contribution I could get because I looked forward to the day I wouldn’t have to work for them. But, in my last five years there, the company was in trouble and cut back in a number of areas. It stopped matching. Still, I continued to contribute to my 401(k) and left the company in 2013 with a fair amount of dinero. I immediately ported the assets to a rollover IRA at Vanguard and have done well since leaving full-time work. Over the years, working for various employers both good and bad as well as setting up my own retirement plans, I ended up with four retirement accounts.

*More Piggies

Just because you have a retirement plan at work that doesn’t mean you can’t set up your own retirement plan at the same time. And, for most people, setting up an IRA can be a good deal. Often a large part of your contributions can be deductible. And possibly a third of your contributions will come back to you in the form of a reduction in taxes. The latter is always a good thing since taxes, in one form or another, are usually the biggest expense we will face during a lifetime of paying for a massive, mismanaged welfare/warfare state that already has “officially” accumulated some $21 trillion of debts (Yes, you are right, perceptive reader. I am skeptical of government figures or of any persons or institutions that keep their own score).

Another little piggy, another saving technique, is to own your own home. Most people will have a mortgage. As you pay it off some good things can happen. One, with each mortgage payment, the amount of equity in your home increases. Second, the government will often let you deduct mortgage interest and some other expenses of the home from your tax bill. Again, given these taxing times and the more taxing future that seems inevitable given the spendthrift ways of our hired help, having as many legitimate deductions is always a good thing.

Here’s another piggy. We take our spare change—quarters, nickels, dimes and pennies—and put them in a jar. We accumulate enough to pay for small expenses and sometimes roll them up and put them in a bank account.

*Live Well

You don’t have to have a miserable financial life just because some people are reckless or because the WSJ says the unpopularity of pensions represents the decline and fall of Western Civilization. The values of our grandparents are here if we just pay attention. They can be rediscovered by almost anyone ready to make a commitment to using money in a sane manner. That is how they made a better life for us. We should always remember their wisdom and their discipline.

*A Message from Gregory Bresiger to Each Reader

I know you.

You are a smart person.

You can do this.

![]()