A Regan Administration’s official dire prediction and advice on how to avoid it by undoing the economic devastation of the Coronavirus.

The Coronavirus destruction, added to the high tax, policies of some states, means the economic damage to parts of the United States will last for years.

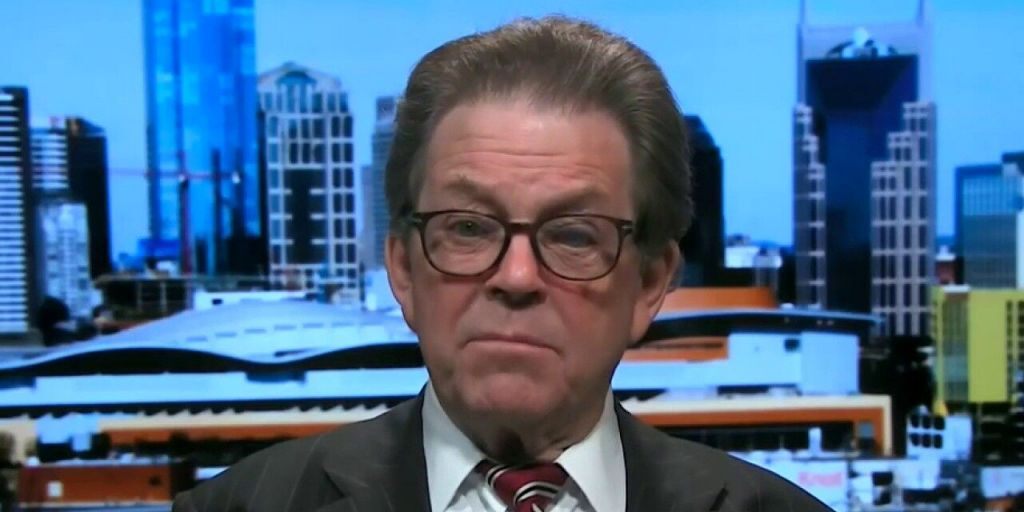

That is the warning of a supply side revolution founding father. Supply side is the philosophy that marginal tax rates are key factors in economic progress.

Economist Arthur Laffer says low taxes are almost always better for growth and generating sufficient tax revenues to fund vital government services. He says many American state and federal lawmakers’ anti-growth policies are hindering recovery. Some states will be hurt more than others.

New York, New Jersey and Connecticut will be the last states to re-open their economies. Laffer argues that they will be the last to recover from the effects of the Coronavirus, in part because of the virus but also owing destructive economic policies of state and city officials.

“We believe that New York, because of the high incidence of coronavirus in the state as well as its late opening date, on top of the strong anti-growth posture, will suffer enormously over the coming years,” writes Laffer in his report, “When and Where Will The Recovery Happen?”

“New York has had a big problem for a long time,” Laffer said in an interview. He advocates shock therapy for New York State, beginning with a zero percent state income tax.

“New York’s economic policies,” Laffer says, “are like a man who has been smoking three packs for years and is told to stop smoking and screams no.” He adds that the problem is partly the result of a governor who is “a demi-god.”

Another Detroit? This Time on the Hudson

Laffer warns that New York City could eventually go the way of Detroit. He says Motor City was once great; that, in his childhood, it was known as “the Paris of the Midwest.” There’s no question, he says, that New York City is on the verge of disaster.

Scott Stringer, New York City Comptroller, recently warned that the city faced a $8.7 billion deficit over the next two fiscal years and will need lots of new help from the federal government.

Stringer’s analysis of the new budget proposed by Mayor Bill de Blasio found that it “relies on drawing down the City’s reserves for nearly half (46 percent) of the value of the gap-closing program.”

The mayor, Stringer notes, is proposing to use contingency reserve funds and some $2.6 billion in the Retiree Health Benefit Trust. In the case of using the trust money, it would “leave just $2.1 billion,” according to Stringer. Some states, Laffer argues, will be better equipped to recover than others like New York.

But Some American Cities and States Will Bounce Back

Those states with pro-growth policies, low taxes and a reasonable regulatory regime, will bounce back fast. They are Arizona, Colorado, Florida, Georgia, Nebraska, Nevada, South Carolina, Utah and Washington.

But what’s to be done for New York and other states and cities facing hard times?

Laffer urges what he calls “anti-growth” cities and states to change policies because they are essential to the national recovery.

However, he contends that federal aid to bail out those cities and states that are in trouble would continue to have “a negative” effect on the U.S. economy.”

The stock market is forecasting a downturn over the next year or two, but “it is not expected to be long-lasting or very deep,” according to Laffer.

He adds that Texas, a pro-growth state, will have some problems because much of its economy is tied to the oil and gas industry.

Taking the Wrong Course

Laffer, a Reagan administration advisor and a sometime advisor to President Trump, also warns that the United States, through cheap money and multiple stimulus spending measures, is putting the nation on a path to challenging Italy and Japan as “the most indebted nation on earth.

The three stimulus packages already passed called for big new spending plans. They depend on new money creation by the Federal Reserve. Now another one is pending. These stimulus plans, Laffer contends, are counterproductive. They “are adding to the burdens borne by the people and businesses,”

The new proposed $3 trillion stimulus package, offered by U.S. House of Representatives Speaker Nancy Pelosi, “will move the U.S. federal net debt to GDP ratio from 0.845 to 1.125. We are now on the path to challenge Italy and Japan as the most indebted nation on earth,” Laffer adds.

What should be done?

Let People Take Home More Money and the Recovery Will Come

Cut taxes and have states open as soon as possible, especially the ones with the biggest impact on the nation’s economy.

Slashing payroll taxes will “strongly accelerate” the recovery by rewarding both work and hiring, Laffer says.

“Every day that states keep their economies closed leads to a cascading negative impact on not only their own economies but the national economy,” he adds.

“A strong national economic recovery will be inhibited if California, Illinois Michigan and New York keep their economies shuttered into the summer months. These four states alone account for one-third of the national output.”

![]()