What I’m Reading

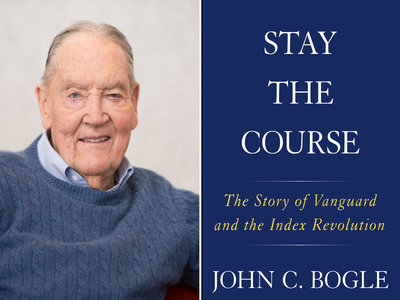

Title: Stay The Course

Subtitle: The Story of Vanguard and the Index Revolution

By John Bogle

(Wiley, New York, $34.95, 279 pages).

This, unfortunately, will be his last book, says the author, the grand

Gregory Bresiger